In Australia, businesses are permitted to pass on payment card surcharging costs to customers. Surcharging is the practice of adding an additional fee onto a transaction when a customer pays with a credit or debit card. This is done to recoup some of the merchant’s fees associated with accepting that particular form of payment.

In fact, not only is surcharging permitted, but it has become common practice in Australia. Like the tipping culture in the United States, surcharging has become part of the payment culture in Australia. In this guide, you’re going to learn everything you need to know as a business.

What is surcharging? Surcharging is the practice of adding a fee to a transaction when a customer pays with a credit or debit card; this is done to recoup some of the merchant’s fees associated with accepting that particular form of payment.

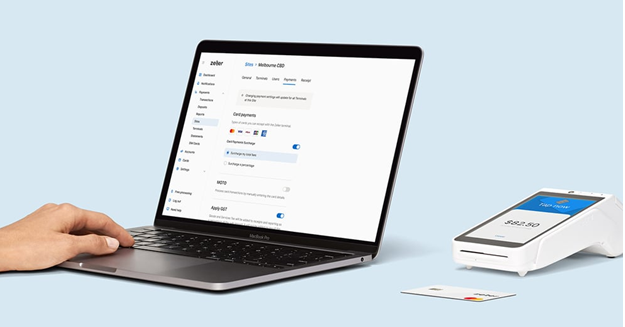

What types of surcharges are allowed? The regulations on surcharging depend on the type of card used and the issuing bank. Thankfully, it’s possible to recuperate some (if not all!) of the costs associated with accepting credit and debit cards through surcharging. Once you set up an EFTPOS terminal, you can surcharge customers and you won’t have to pay transaction fees again.

What are the benefits of surcharging? The primary benefit is that it allows you to pass along the cost of card acceptance to customers who choose to pay with credit or debit. This way, you won’t have to bear the full brunt of card processing fees. Because of the cost savings, many businesses opt to use surcharging as a way to offer discounts to customers who pay with cash or check.

Tips to Implement Surcharging

So, how do you go about implementing surcharging in your business? Here are some tips to get you started:

1. Educate yourself on the rules and regulations. Before you implement surcharging at your business, make sure you understand all applicable and state laws. Be aware of any changes in laws that determine the level of surcharge you can impose.

2. Choose your payment processor carefully. Your chosen payment processor should be able to guide you through the process of setting up surcharging and provide assistance in meeting laws and regulations.

3. Inform customers about your surcharging policy. Make sure customers are informed of your surcharging policy and that they know how much the surcharge is; this will help avoid any surprises when it comes time to pay. As mentioned, surcharging is part of the payment culture in Australia so consumers are now accustomed to this practice.

4. Set the right surcharge amount. Setting a surcharge that is too high may lead customers to look for other payment options. A good rule of thumb is to set the surcharge at no more than the cost charged by your payment processor; any additional costs should be absorbed by the business.

With these tips in mind, you can implement surcharging in your business without worry. Customers may be more accepting of surcharges if they understand why it is necessary, and the right surcharge amount helps to cover costs without hurting your customers. Good luck!

Related posts

When was the first presidential election in the US?

The election process in the world’s most powerful nation, the US, has come a long way. Various amendments have been made to the Constitution that allowed black men, white women and other disadvantaged groups to participate in the elections. Further amendments during the 60s and…

Tips & Trick For Healthy Glowing Skin

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam laoreet, nunc et accumsan cursus, neque eros sodales lectus, in fermentum libero dui eu lacus. Nam lobortis facilisis sapien non aliquet. Aenean ligula urna, vehicula placerat sodales vel, tempor et orci. Donec molestie metus a sagittis…

My Fight With Depression. Concussions

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam laoreet, nunc et accumsan cursus, neque eros sodales lectus, in fermentum libero dui eu lacus. Nam lobortis facilisis sapien non aliquet. Aenean ligula urna, vehicula placerat sodales vel, tempor et orci. Donec molestie metus a sagittis…

Top 10 most visited tourist places in the world

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nam laoreet, nunc et accumsan cursus, neque eros sodales lectus, in fermentum libero dui eu lacus. Nam lobortis facilisis sapien non aliquet. Aenean ligula urna, vehicula placerat sodales vel, tempor et orci. Donec molestie metus a sagittis…

How Digital Health Technology Is Beneficial?

Digital health revolves around the usage of diverse technological platforms including mobile health, teen health, configurable remote patient monitoring, etc to improve the connection between the patients and the doctors. Across the healthcare system, the horizon and scope of digital health have helped create opportunities…

How Latest Farmtrac Tractors are Improving Farming in India?

India mostly relies on farming, and a large part of the population depends on it for their livelihoods. Recently, there’s been a big shift towards using modern farming techniques and machinery to make farming more productive and efficient. A good example of this is the…

Dispelling Myths: Demystifying Rx Waste and Expiration Dates – WasteX Pharmaceutical Waste Disposal Separates Fact from Fiction

The specter of “expired” medication looms large, conjuring images of potent chemicals wreaking havoc on water sources and ecosystems. But before you panic toss that bottle of pills, let’s delve into the truth about pharmaceutical waste and expiration dates, separating fact from fiction. At WasteX…

Sustainable Living in Memphis: Green Initiatives and Eco-Friendly Hotspots

Memphis, a city known for its rich cultural heritage and vibrant atmosphere, is increasingly becoming a hub for sustainable living. As environmental awareness continues to grow, residents and businesses in Memphis are embracing green initiatives and fostering eco-friendly practices. Let’s explore the city’s commitment to…

Today's pick

Hot topics

Stay connected

Meet the Author

Gillion is a multi-concept WordPress theme that lets you create blog, magazine, news, review websites. With clean and functional design and lots of useful features theme will deliver amazing user experience to your clients and readers.

Learn moreCategories

- Animals (7)

- Apps & Softwares (8)

- Automotive (8)

- Beauty (8)

- Business (141)

- Cars (12)

- Cartoon (3)

- Cook (4)

- Cooking (1)

- Design (8)

- Economy (6)

- EDUCATION (25)

- Entertainment (16)

- Fashion (23)

- Fitness (2)

- Food (16)

- Gaming (51)

- Guide (20)

- Health (119)

- Home (52)

- Home improvement (12)

- Interior (3)

- Law (16)

- Life (1)

- LifeStyle (99)

- Marketing (5)

- Motivation (9)

- Movie (6)

- Movies (1)

- Music (3)

- News (8)

- Painting Art (1)

- People (15)

- Photography (7)

- Review (113)

- Services (7)

- Social Media (6)

- Sport (9)

- Sports (12)

- Style (10)

- Swimming (1)

- Tech (125)

- Travel (26)

- Uncategorized (17)

- Vape (5)

- Western (3)

- World (2)